Recently, the fintech corporation, PayPal, has revealed its cryptocurrency portfolio. The information was shared in a quarterly report to the US Securities and Exchange Commission (SEC).

The company allows its clients to trade cryptocurrencies and use earnings to pay for sales at checkout.

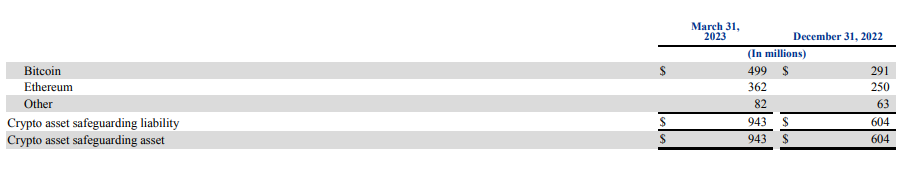

As of March 31, PayPal recorded a total of $943 million in crypto holdings. This estimate is 56% more than the firm’s crypto holdings in Q4 2022 of $604 million.

The report shows that Bitcoin is responsible for $499 million of the total while $362 million is held in Ethereum. Other cryptocurrencies, such as Bitcoin Cash and Litecoin, make up $82 million of PayPal’s assets.

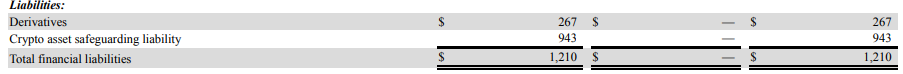

Cryptocurrencies have also contributed significantly to the company’s financial liabilities for the quarter of $1.2 million. It was disclosed that these digital assets comprise 77.93% of PayPal’s financial liabilities, which is more than 10% of that in Q4 2022.

PayPal Proudly Carries The Crypto Banner

In November 2022, PayPal started its hold-and-sell Bitcoin feature in America. Years later, PayPal extended its crypto services to the customers in Luxembourg.

Shortly after that, in December 2022, the fintech company partnered with MetaMask to allow users to trade Ethereum via the platform. PayPal users can also buy crypto on the popular crypto exchange platform Coinbase with their debit cards.

As you can understand from the examples, PayPal is considering the existence and importance of cryptocurrencies. We think that other popular and successful financial companies will enter the crypto space in the future.

Lifted A.

Lifted A.