Kasikornbank, the second-largest bank in Thailand in terms of assets, has initiated a $100 million fund dedicated to Web3 and artificial intelligence (AI) investments. The fund will be injected into the Asia Pacific’s burgeoning internet economy. The region’s economy is projected to reach a valuation of $1 trillion by 2030.

Over the past few months, crypto and Web3-related companies have flourished in Asia. The continent has drawn substantial investments to the region’s economic hubs in Hong Kong, South Korea, and Singapore. This is partly due to a crackdown on crypto by the United States.

Besides offering financial backing, the bank’s partners will provide aspiring companies with access to corporate assets and valuable insights.

The fund, known as KXVC, will be offered to more than 30 startups globally. The bank intends to specifically focus on the United States, the European Union, Israel, and APAC.

Krating Poonpol, the chairman of KBank Business Technology Group, stated that KXVC will be a launching pad for global founders to propel their business expansion in APAC, leveraging robust synergy with KBank and its partners.

KXVC intends to allocate investments toward consumer-focused AI, cybersecurity, and AI and machine learning tools encompassing deployment platforms. Also, it will invest in data annotation, model optimisation, and problem-specific AI startup ventures.

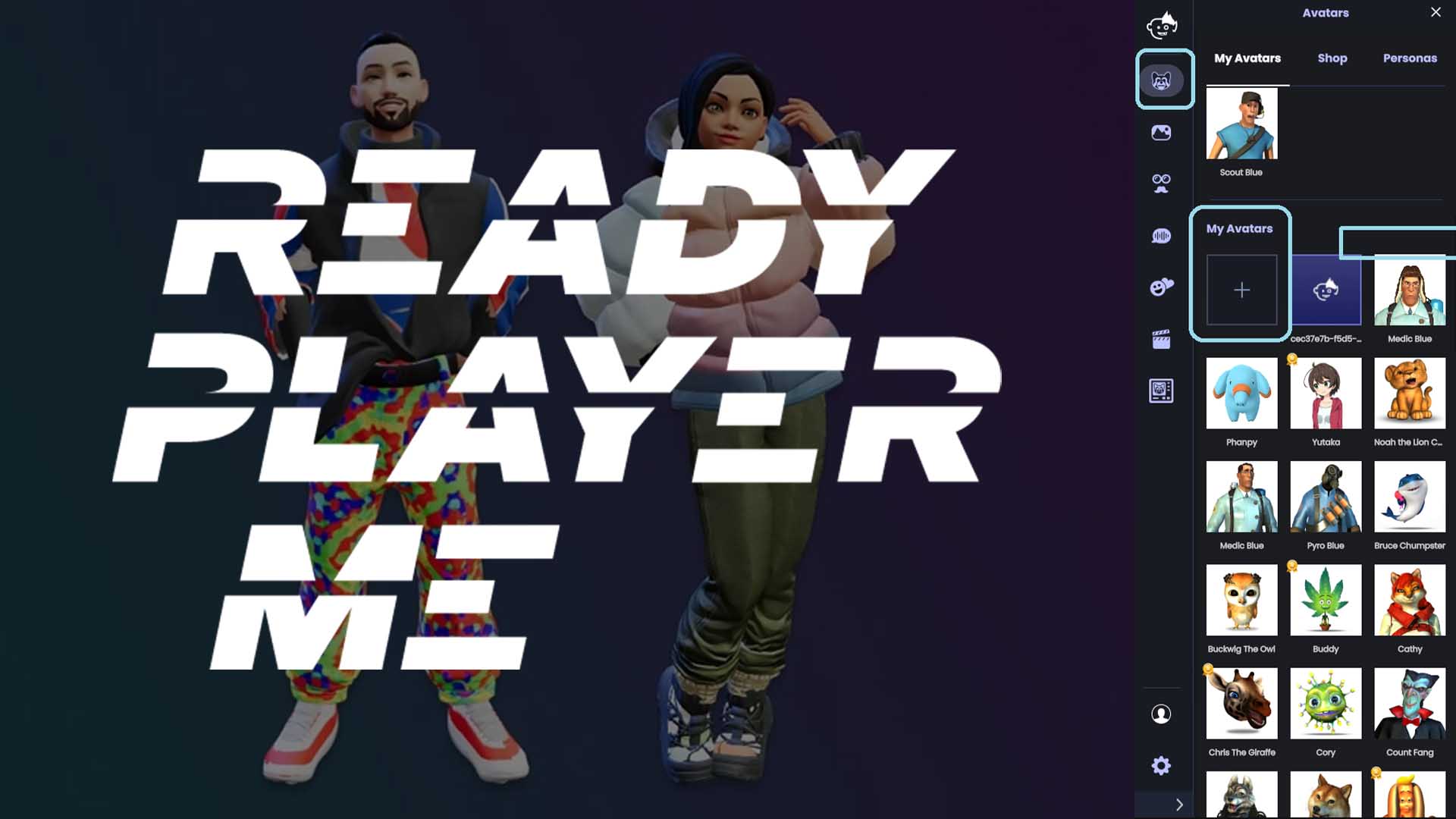

In the Web3 side, KXVC will revolve around Web3 infrastructure development, node validator services, and remote procedure call providers. Furthermore, Kasikornbank will invest in middleware technologies, modular solutions, privacy enhancements, wallet innovations, alternative layer-1 and layer-2 solutions, and more.

The Kasikornbank KXVC Fund will investigate opportunities to fund various artificial intelligence companies. It has previously allocated investments to the digital asset advisory firm Cryptomind and Singapore-based multifunction app Grab.

KBank has a history of involvement in the digital economy. In 2018, the bank joined Visa’s blockchain-based business-to-business solution for facilitating cross-border payment transactions. Additionally, in 2021, it initiated experiments with decentralized finance (DeFi) services to expand its business.

Lifted A.

Lifted A.