The 2022 global cryptocurrency adoption index report has been published. The crypto adoption index measures where people put a huge chunk of money into crypto. This year’s report comes with surprising insights from countries you won’t expect. In this blog piece, we’ll be spilling some tea on the results that caught our eye.

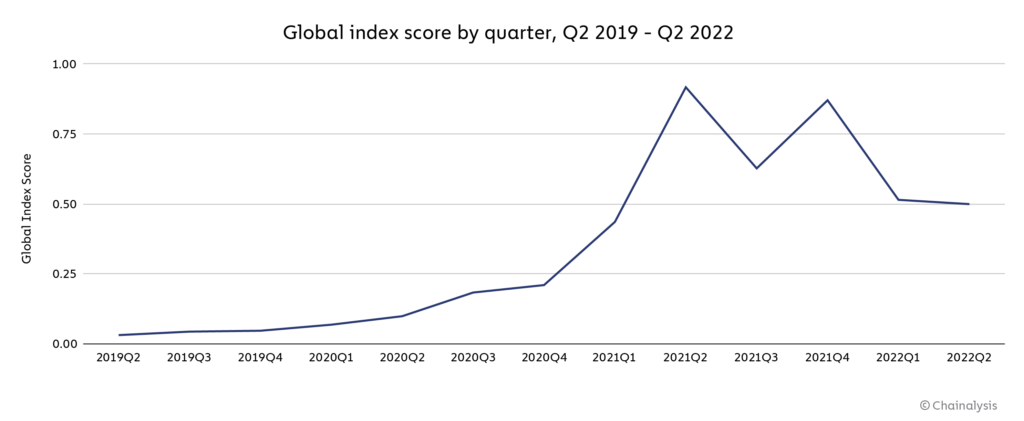

Overall, crypto adoption slowed worldwide in the bear market due to several factors, but it remained above pre-bull market levels. Data from this latest report showed that global adoption has leveled off in the last year after growing consistently since mid-2019. Significant, long-term holders continued to hold through the bear market and are optimistic that the market will bounce back. This feeling makes the market highly competitive despite the fluctuations.

Chainalysis took a different approach to collate data and create this year’s report.

They added two sub-indexes based on DeFi transaction volume. Then, they modified two other sub-indexes to include only transaction volume associated with centralized services to highlight countries leading the way in DeFi and address DeFi-driven inflation of transaction volume.

Here’s what we found out when we took a look at the report:

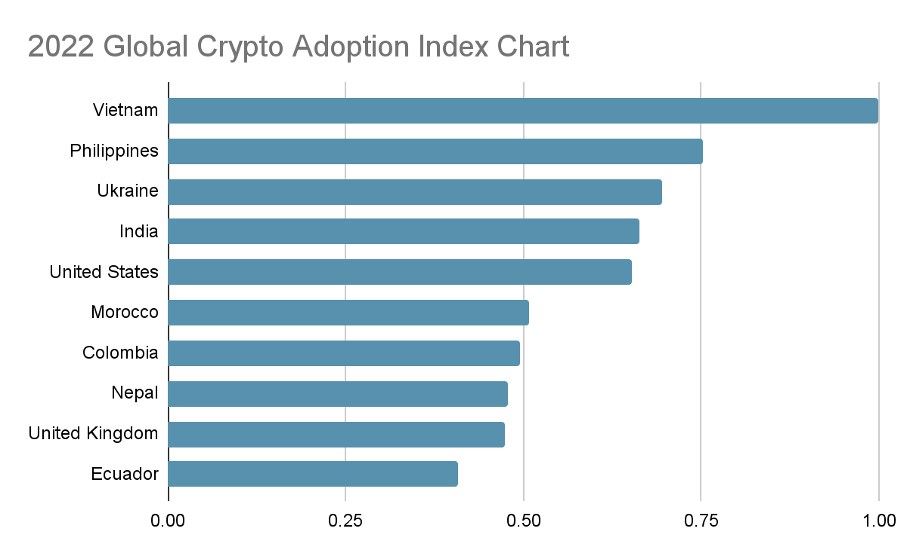

Interest is high in countries experiencing a serious economic crisis or high inflation!

An interesting trend last year that has only gotten stronger this year is that: emerging markets in areas experiencing inflation or serious economic crisis dominate the index. Some countries, like Vietnam, the Philippines, Ukraine, India, Pakistan, Nigeria, Nepal, Kenya, and Indonesia, are classified as lower-income middle-income countries. The report further reveals that users in lower-middle-income countries (mentioned above) and upper-middle-income countries like Brazil, Turkey, Thailand, China, Argentina, Colombia, Russia, and Ecuador use cryptocurrency to preserve their savings, carry out transactions and fulfill other financial needs unique to their economies. They seem to lean on Bitcoin or stablecoins more than other countries.

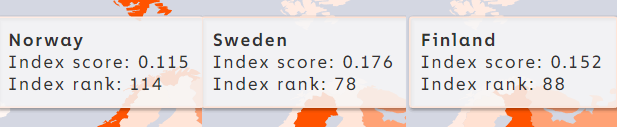

Scandinavian countries are far behind

Apart from the United Kingdom, Ireland, and France, Europe is far behind the global average for crypto adoption. They found that about 35 percent of non-crypto holders in the Scandinavian countries (like Denmark and Sweden) had security concerns, while 34 percent said they didn’t know how to buy or hold crypto. These countries also had the highest number of people who didn’t trust crypto – compared to other respondents globally. So, in 2022, crypto adoption is still slow in these parts of Europe, with only 7% of those who haven’t bought crypto planning to buy, as opposed to 21% globally.

Bear market vs. bull market adoption

Users believe it’s best to buy crypto when the market is bearish, but data from the report suggests that most new users who buy during pump periods tend to stay even when prices decline – thus, balancing out the market cycle. The reason for this behavior might be that some users find value in crypto, like in those emerging markets where it is seen as an alternative to fiat currencies because crypto provides tangible benefits to people living in unstable economic conditions.

Uzoamaka U.

Uzoamaka U.