For protecting and keeping our digital assets, we must utilize wallets, and there are different types of digital asset wallets. For example, we can use hot wallets which are digital wallets keeping digital assets and are connected to the internet. On the other hand, cold wallets can also be used by people who want to utilize a hardware device to keep their digital assets. The main difference between hot and cold wallets is being virtual or in real life.

In addition to hot and cold wallets, custodial and non-custodial wallets must be considered. The main difference between these types of wallets is about private keys. Let’s focus on these types of wallets together!

Before explaining custodial and non-custodial wallets, the explanation of ‘private keys’ must be made. A private key is a secure code which allows a digital asset holder to make transactions and show his/her ownership of the digital asset.

Custodial Wallets

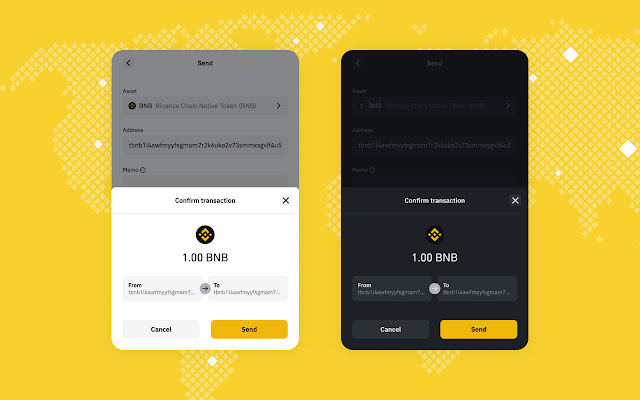

A custodial wallet depends on a third party, and this party holds the private keys. In other words, the holders of digital assets and private keys are controlled by a third party if the people use custodial wallets. These people can make transactions by giving permission to the third party via their wallets.

When we look at the advantages of custodial wallets, we can state that this wallet type is easy-to-use for beginners in this field and requires less responsibility. Because of these features, a lot of people can adopt cryptocurrencies, blockchain technology, and NFTs by using custodial wallets quickly.

On the other hand, custodial wallets have a critical side for hackers; these wallets encounter a lot of cybercrimes. Also, the existence of a third party is another disadvantage for some people. Moreover, the simple structure of custodial wallets cannot offer advanced properties for experts in this field.

Binance, Coinbase, and Blockchain.com are the popular examples of custodial wallets. If you want to have less responsibility and simple usage in terms of cryptocurrency transactions, you can consider these examples.

Non-Custodial Wallets

As its name implies, non-custodial wallets are the opposite of custodial wallets. This wallet type gives the control of private keys and funds to their holders. Due to this circumstance, the wallet type supports the statement of ‘’Not your keys, not your crypto’’.

This wallet type is more complex than custodial wallets, so non-custodial wallets are more appropriate for experts in this field. In other words, we do not suggest the usage of non-custodial wallets to crypto beginners because of their difficulty, but the safety is higher in them.

Non-custodial wallets are fast, and the creation of new non-custodial wallets is easy. Furthermore, this wallet type offers more advanced functions to crypto experts. However, the recovery of digital assets is impossible when a non-custodial wallet is used. In other words, if a person lost her/his private keys, the person must say goodbye to her/his digital assets.

Almost every custodial wallet is based on web while there are two types of non-custodial wallet: Software and hardware. Software non-custodial wallets are accessible via a mobile application or website, and they store and encrypt private keys. On the other hand, hardware non-custodial wallets look like a USB thumb drive, and they are the most secure way to hold digital assets. Hardware wallets that are also known as cold wallets become online if they are connected to a mobile device or computer. Ledger Nano X, Electrum, Zengo, and Wasabi are the most known examples of non-custodial wallets.

Final Words

There are different advantages and disadvantages of custodial and non-custodial wallets. For example, you can recover your cryptocurrencies easily when you are using a custodial wallet, but this situation is not possible with non-custodial wallet. On the other hand, there is no third party in the usage of non-custodial wallet, but custodial wallets have third parties to keep your private keys. Because of these differences, you should focus on these wallet types’ properties for your digital assets.

Irem B.

Irem B.