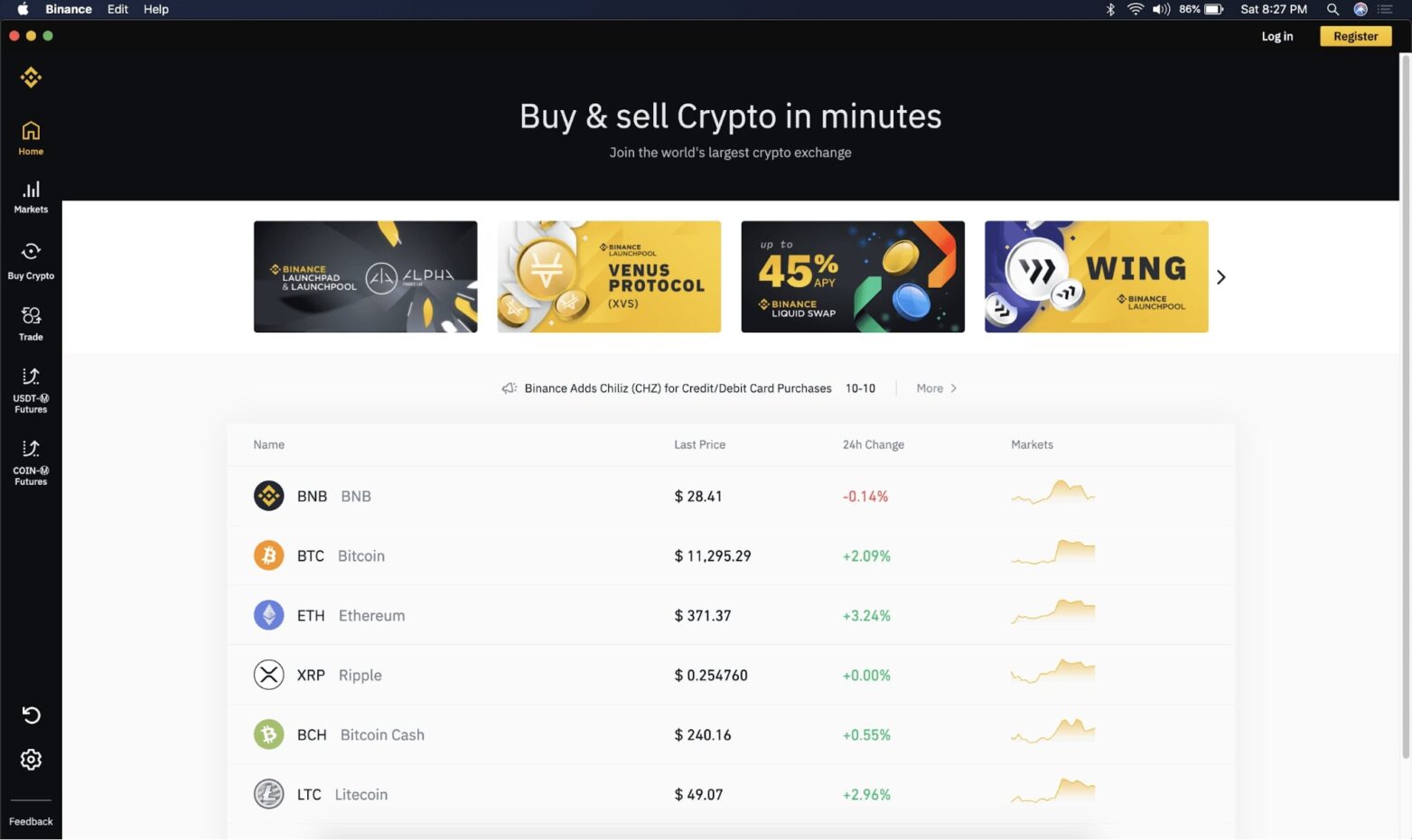

The main tools for investing in cryptocurrencies are cryptocurrency exchanges, and there are different crypto exchange platforms. According to CoinMarketCap, the top three crypto exchanges by volume are Binance, Coinbase, and Kraken. These top exchange platforms are centralized, but there are also decentralized crypto exchanges.

Before explaining the different types of crypto exchanges, we must explain ‘crypto exchange’ notion. A crypto exchange is a necessary platform in which people can sell or buy digital assets. Shortly, people without knowledge about crypto exchanges cannot be crypto investors properly.

Now, we can focus on the two different types of crypto exchange together!

What is Centralized Crypto Exchange?

As its name implies, a centralized crypto exchange (CEX) allows users to sell and buy digital assets with a third party.

In this type of crypto exchange, third parties or intermediaries check the transactions of digital assets on the platform. If there is a security gap among the transactions, these parties deal with this situation.

You can think that centralized crypto exchanges are similar to traditional banks because users must provide their personal information to get verification, like in banks. Like individuals, organizations must also provide necessary details about their organizations. With the verification, users/organizations can reach all services on centralized exchanges.

According to their traffics, liquidities, and trading volumes, Binance, Coinbase, Kraken, KuCoin, Bitfinex, and Gemini are popular centralized crypto exchanges.

The Pros of Centralized Crypto Exchanges

Easy-To-Use

Firstly, we can say that centralized crypto exchanges are user-friendly because, as we emphasized above, they are similar to banks. You can easily create your account on a centralized exchange, like opening a bank account.

Also, you can reach detailed guides of centralized exchanges, so you can get answers to your questions about these exchanges.

These crypto exchanges generally have a simple structure, so both crypto beginners and experts deal with digital assets quickly. Moreover, due to the chance to pay with credit and debit cards, everyone can buy their first digital asset easily on centralized exchanges.

Support and Safety Insurance

Centralized crypto exchanges rely on a third party or intermediary, so the support towards users is very high. Generally, centralized exchanges have customer support, and the support arm helps users in any subject, like losing access to the exchange.

In addition to this support, you can get safety insurance by paying a small extra fee to protect your digital assets in a centralized crypto exchange from cybercrimes.

The Cons of Centralized Crypto Exchanges

Digital Attacks and Bankruptcy Risk

Although centralized crypto exchanges focus on the security of users, hackers and thefts organize a lot of attacks on these platforms. Due to this circumstance, the risk of losing digital currencies is higher in centralized exchanges.

Like the possibility of cybercrimes, the risk of bankruptcy is higher in centralized exchanges. For example, FTX was a popular centralized crypto exchange, and it went bankrupt. With the bankruptcy of FTX, a lot of crypto enthusiasts were confused and started to suspect the existence of the crypto world.

Fewer Crypto Types

Centralized crypto exchanges do not focus on crypto variety. In other words, most of the centralized exchanges offer fewer crypto types, so users cannot reach different types of cryptocurrencies.

If you are a crypto investor dealing with popular cryptocurrencies, like Bitcoin and Ethereum, there is no problem. However, if you want to meet different cryptocurrencies, you must exceed the boundaries of centralized exchanges.

What is Decentralized Crypto Exchange?

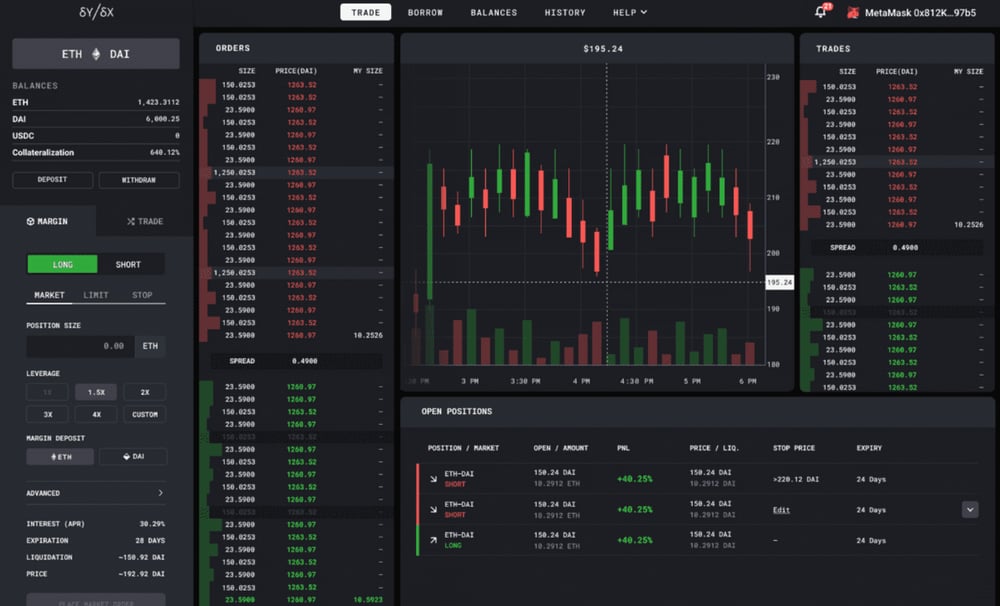

The opposite version of a centralized crypto exchange is a decentralized crypto exchange (DEX). In other words, there is no third party or intermediary in decentralized exchanges.

While users must deposit their funds to a third party, the situation is not valid in decentralized exchanges. In this type of crypto exchange, smart contracts and self-custodial wallets are critical subjects for transactions.

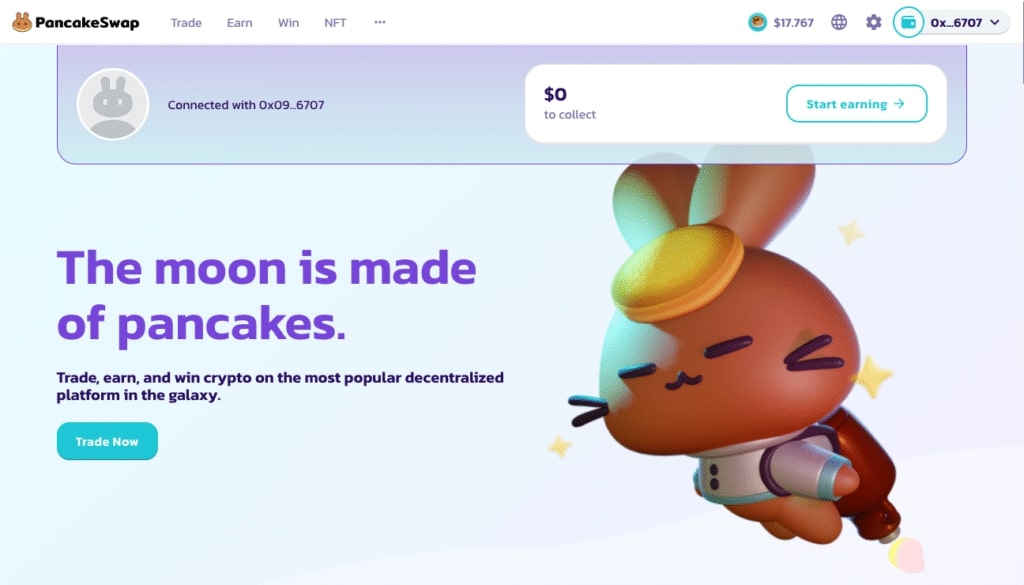

According to their traffics, liquidities, and trading volumes, dYdX, Uniswap, Curve Finance, PancakeSwap, and Kine Protocol are popular decentralized crypto exchanges.

The Pros of Decentralized Crypto Exchanges

Privacy and Security

Unlike in centralized exchanges, you do not have to share your personal information to sell or buy digital assets in decentralized crypto exchanges. Hence, if you are considering your privacy, you can prefer decentralized exchanges.

Although centralized exchanges consider user security, this consideration is not enough. Due to the complex structure of decentralized exchanges, they give a more secure environment than centralized exchanges. Hence, the access of hackers and cyber attackers is quicker and easier in centralized exchanges than in decentralized exchanges.

Low Costs

As there is no intermediary in decentralized crypto exchanges, charge fees for transactions are lower than in centralized crypto exchanges.

Decentralized exchanges generally use the gas fee structure, and users pay small fees, approximately 3%, thanks to this structure.

The Cons of Decentralized Crypto Exchanges

Complex-To-Use

Although decentralized exchanges give users more control, the platforms are complicated. For instance, there are different notions, like gas fees, liquidity pools, and so on, and learning all notions in decentralized exchanges is not easy.

Due to the complex structure of decentralized exchanges, we can say that crypto beginners have difficulty if they first start to use a decentralized exchange to buy digital assets.

No Acceptance for Credit or Debit Cards

As we mentioned above, you can buy a crypto or token by using your credit or debit card. However, the same situation is not valid in decentralized exchanges because most of the decentralized exchanges do not offer payment options with credit and debit cards.

Nowadays, some decentralized exchanges make deals with third parties to accept credit and debit cards because this circumstance is important for the newbies in the crypto space.

Final Words

If you are a beginner in the crypto world, we are suggesting the use of a centralized crypto exchange to start making investments. If you want to encounter new projects and the world of DeFi, you can use decentralized crypto exchanges.

As you can realize, there are different advantages and disadvantages of both crypto exchange types, so you should consider your own circumstance to decide which exchange type is right for you.

Irem B.

Irem B.