Alcor Exchange is a decentralized exchange built on the EOSIO blockchain technology to integrate WAX, BOS, TELOS, EOS, and Proton blockchains. It has made $6 Billion in trade volume since 2020, distributed as 43 Million swap transactions and 42 Million limit order transactions.

The concentrated liquidity feature affects the working mechanism of the liquidity pools that enable swap transactions. Alcor Exchange brings the ability to add liquidity in specific price ranges to liquidity providers with its newly introduced concentrated liquidity feature. This means liquidity providers can gain more with the same money, in other words, they can gain the same with less capital.

You can look at Alcor Exchange’s Twitter thread to check their announcement for concentrated liquidity.

How Does Concentrated Liquidity Work?

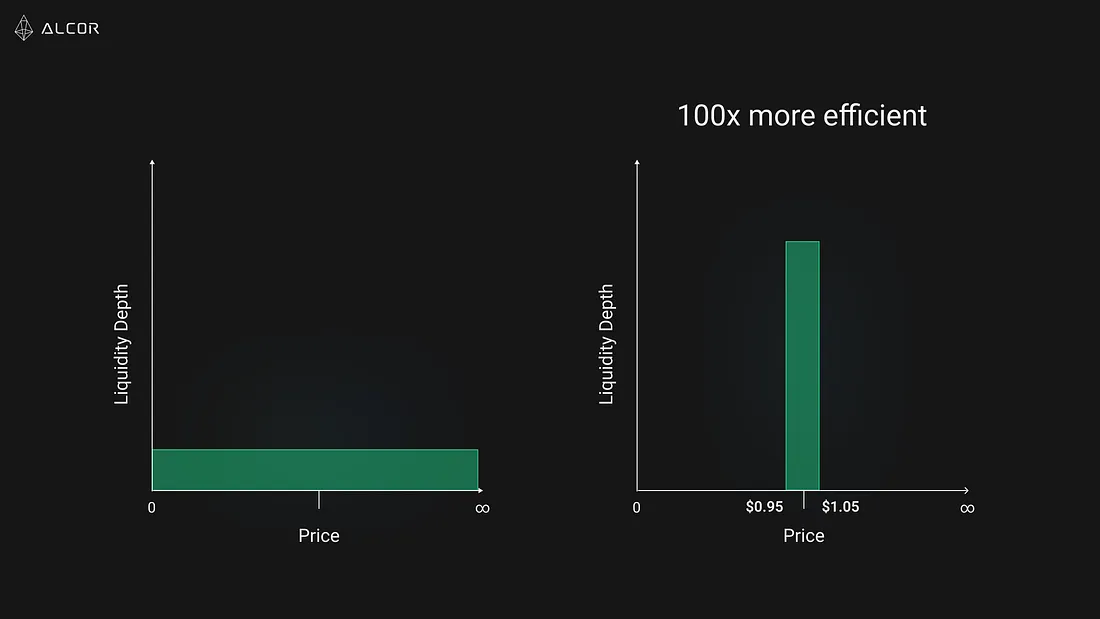

Swaps provide services to those who want to exchange tokens in this parity by keeping two currencies in a pool. Those who balance the two tokens in this pool are called liquidity providers. However, in the classical liquidity pool operating system, these liquidity providers were working with a system that assumed that all price ranges could be realized, causing them never to use the liquidity they set aside for these ranges and keeping money in vain in those ranges.

In the concentrated liquidity system, liquidity providers determine a price range. As long as they do not go beyond this price range, the tokens in their hands continue to receive a fee from the trading volume more efficiently. Of course, if this range is exceeded, only one type of token remains in their hands, and they can no longer make money from trading fees. However, in case of entering the same range again, the token amounts are balanced again, and they continue to earn fees again.

How Does Alcor Exchange v2’s Concentrated Liquidity Benefit Users?

Concentrated liquidity can solve most of the projects’ liquidity problems in the swap pool with more efficient use of capital. A large amount of liquidity created by concentrated liquidity will allow users to trade tokens with less slippage difference during the swap. The user who wants to trade a token used in the game will be able to focus on enjoying the experience gained in the game without worrying about liquidity problems.

How to Become a Liquidity Provider in Alcor Exchange?

Alcor Swap has a liquidity add interface in the pool section where you can manage your positions. There, you can determine the range of liquidity you will provide and see the rate you need to provide in 2 tokens from the parity with the calculated rates. For example, in WAXP/TLM parity, with the liquidity, you will provide between -5% and +5%, you can provide liquidity to the liquidity pool with a 0.3% fee tier. Also, you can add multi liquidity to customize your position weight in different price ranges.

In the estimated earning model of Alcor Exchange, when the TLM/WAXP liquidity pool is within the range of +5% to -5%, the earnings for providing $1150 liquidity amount to $7.7 per day. In comparison, providing $1150 liquidity within an infinite range results in earnings of $0.24 per day. When we look at the ratios in this example, being a liquidity provider within the expected range of the price is a more efficient use of capital than classical liquidity providing.

Conclusion

The inclusion of a concentrated liquidity version in DEX swaps transformed decentralized exchanges. This novel strategy improves liquidity provision, decreases slippage, and increases trading efficiency. It is an important step forward for DEXs, encouraging increasing adoption and liquidity in the DeFi ecosystem. The introduction of concentrated liquidity opens the door to a more robust decentralized trading scene.

DISCLAIMER: Information on this website is provided solely for informational reasons and makes reference to opinions. It isn’t meant to serve as investment advice. For guidance on making investments, consult a legally qualified specialist.

Lifted A.

Lifted A.